My watch Journey

I have always liked watches but in recent years, I have gotten more serious about learning more about the details and history of horology and the many great watchmaking companies (maisons).

Previously, I would get very inexpensive (cheap) watches but I decided to buy timepieces that can actually last for a lifetime and my children can actually inherit.

As I learned more, I quickly figured out what I liked and what I would like to collect over time.

Without further ado, my favorite watchmakers.

Honorable Mention

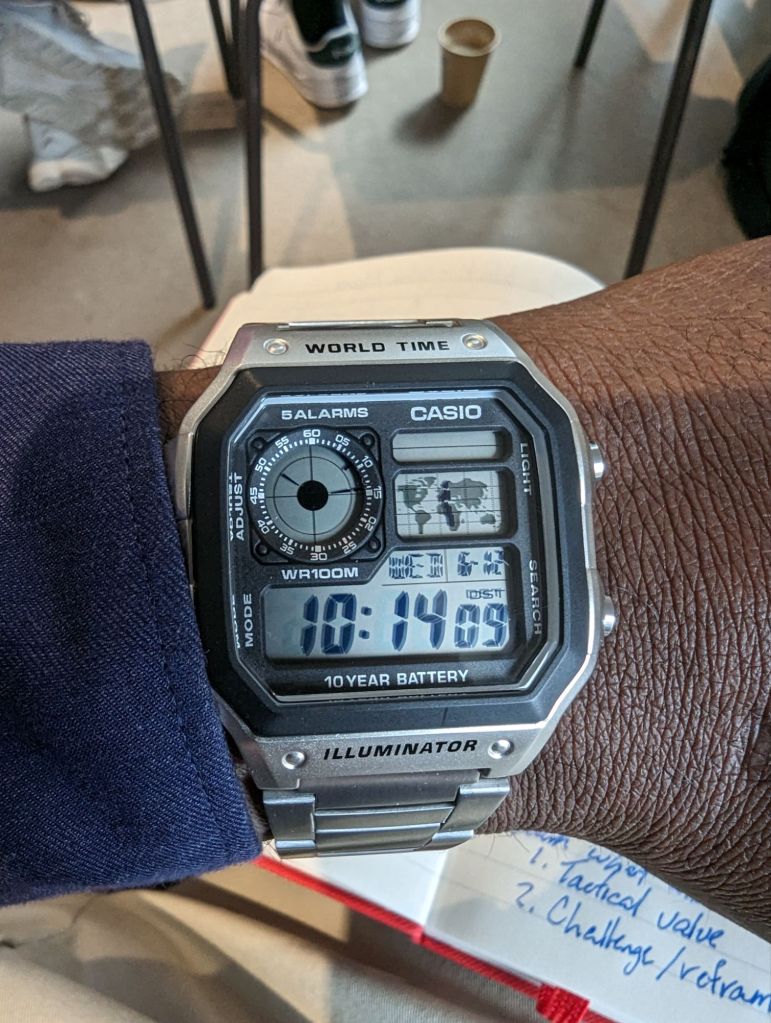

Casio/G-Shock

Favorite watch that I have: Casio World Timer

Like many collectors, Casio—especially G-Shock—was my gateway into the world of watch collecting. I got my first Casio from a friend who was downsizing his possessions, and since then, I’ve picked up a few more. I love the rugged look and solid build you get for such an affordable price.

Today, I have four Casio watches in my collection, and they still get regular wrist time.

My five favorite watch brands

5. Patek Phillippe

Favorite watch that I want to have: Grand Complication

Out of the “Holy Trinity” of watchmakers —Patek Philippe, Audemars Piguet, and Vacheron Constantin—Patek Philippe is my personal favorite. While many gravitate towards Audemars Piguet, especially for the Royal Oak, something about Patek’s understated elegance and technical mastery speaks to me.

Patek Philippe was the first watchmaker to produce timepieces with perpetual calendars, which is one of my favorite complications. Their watches, known for their incredible craftsmanship, are also widely considered investment pieces, often appreciating in value over time.

4. Rolex

Favorite watch that I want to have: GMT Master II (“Coke”)

I know. I know.

Rolex. The name is synonymous with luxury and success, making it almost impossible to ignore. Rolex has built its reputation not just through exceptional timepieces but through decades of powerful marketing. Even as a child, when I knew very little about watches, I understood the significance of owning a Rolex.

However, while I respect the brand and hope to own one someday, it’s not my top favorite. Still, Rolex’s craftsmanship and iconic models like the Submariner and GMT Master II keep them firmly on my radar.

Fun fact: Rolex invented the first waterproof watch, the Oyster, in 1926.

3. Omega

Favorite watch that I want to have: Omega Speedmaster Professional (“Moonwatch”)

Omega, much like Rolex, has a way of embedding itself into both the luxury world and popular culture. From its role as the official timekeeper of the Olympics to its prominent place on James Bond’s wrist, Omega has created a broad and enduring appeal.

The Omega Speedmaster Professional, better known as the “Moonwatch,” earned its place in history as the first watch worn on the moon. Omega never misses an opportunity to remind us of that fact, but it’s part of the brand’s rich heritage—and honestly, who wouldn’t want to own a watch with that level of history?

And you know what? I’m sold.

Omega’s watches are also more accessible compared to Rolex, making them a popular gateway into luxury watches.

Side note: What’s deemed “Luxury” is subjective and based on the person but I digress.

They balance heritage with innovation, like their groundbreaking co-axial escapement technology, which reduces friction in the movement, increasing the longevity of the watch.

2. Hamilton

Favorite watch that I have: Khaki Field Day Date

When I was ready to step up my watch game, Hamilton stood out. They offer excellent value, especially with their ETA-based movements, which are easy to service. Being part of the Swatch Group gives them access to reliable movements while keeping costs reasonable.

What really drew me to Hamilton was their deep history. Originally an American brand, Hamilton was based in Lancaster, Pennsylvania—known as the “Cradle of American Watchmaking.” They later became the official supplier of field watches for Allied forces in WWII. Even today, Hamilton is synonymous with rugged, dependable field watches.

That has led me to get the now discontinued Khaki Field Day Date (reference H70535531).

Other than its pedigree with field watches and connection to the military, Hamilton is also known for its connection to another area: Cinema.

Hamilton has a rich history of being featured in over 500 films since the 1930s, making it one of the most visible watch brands in Hollywood. This strong connection to cinema has helped solidify Hamilton’s reputation as the “director’s watch,” with their timepieces often chosen for their blend of history, design, and functionality.

One of my favorite films, Christopher Nolan’s Interstellar, featured two custom Hamilton watches. The “Murph” watch became iconic thanks to its role in the movie, but I personally went for the other watch, the Khaki Aviation Pilot Day Date, nicknamed the “Coop.”

1. IWC

Favorite watch that I want to have: Big Pilot’s Watch Perpetual Calendar

The International Watch Company (IWC) is, without question, my favorite watch brand. Known for its aviation heritage, IWC’s connection to pilot watches dates back to WWII, when it was one of the five watchmakers supplying the German Air Force.

Their Big Pilot’s Watch is IWC’s flagship collection, and their perpetual calendar complication—designed by Kurt Klaus—is legendary.

Today, IWC is known for its innovation, particularly in the use of advanced materials like ceramic and titanium. The company also announced a groundbreaking 10-year engineering collaboration that resulted in the creation of the first watch made from ceramic matrix composite (CMC).

Honestly, I may not fully understand all the technical details, but this material is said to be highly resistant to extreme temperatures and incredibly strong and durable.

Also, IWC is pushing the boundaries of timekeeping and accuracy. Recently, IWC developed a perpetual calendar that is accurate for the next 400 years while keeping account for the moon phases for the next 45 MILLION YEARS.

Despite their technical prowess and bold designs, IWC remains relatively unknown to casual watch enthusiasts, which adds to their allure. True collectors know the value and beauty of an IWC.

The Big Pilot’s Perpetual Calendar is my ultimate grail watch, and I hope to add it to my collection one day.

Conclusion

My love for watches has evolved quickly from a strong interest to a strong interest combined with growing knowledge and awareness. I’ve come to appreciate not only the design and mechanics but also the history and stories each timepiece carries. Whether it’s the moon landing with Omega or field-tested durability with Hamilton, each watch tells a story and each watch allows you use it as an extension of your style and personality.

I was a little slow to dive into the hobby but I am here now. Let’s go.