The only things guaranteed in life are death and taxes.

Unfortunately for American expats, taxes is double the trouble on a yearly basis. Luckily, death is still a singular occurrence no matter where you live. I think nobody wants to experience death more than once but I digress.

But yes, American expats experience the pleasure of taxes of back home and the country of residence. The United States is one of two countries (the other being world power Eritrea) that “double tax” it’s companies and citizens. A great example of that good ole “American Exceptionalism”.

However, the recent tax bill passed by congress removed the double taxation on companies but not on citizens and green-card holders who live abroad.

Even Meghan Markle will be in the cross-hairs of the IRS every year she files taxes while living in the United Kingdom as a member of the British Royal Family.

And that is not just filing tax returns on income. Any asset you have including property, bank accounts and private or public pensions have to be reported to the IRS. This is the main area where it gets tricky as you will be wise to account for anything and everything in your name.

And that includes any assets shared between you and a non-American spouse. That is where it is most complex and Megan will have to account for that due to her future marriage to Prince Harry.

My marriage is nowhere near as high profile but I am in the same situation due to my marriage to my Swedish wife Sanna.

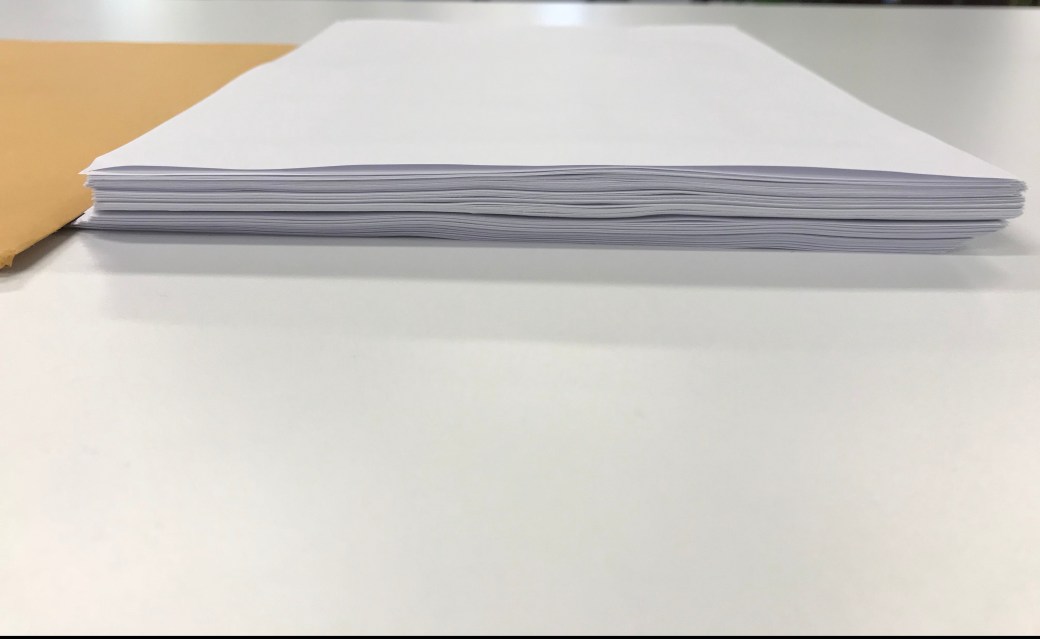

Only a few days ago I sent this year’s tax filing in the mail from here in Sydney to the designated location for tax filers abroad which is in Austin Texas. Just in shipping alone I had to spend 41 Australian Dollars (roughly 32 American Dollars) to meet my legal requirement of filing taxes for the year while also proving that I am not making enough money to owe the US Government and also disclosing every single account or asset I have outside of America to ensure Uncle Sam that I am not hiding any money Panama Papers-style.

This was the thickness before I included records of my British bank accounts which was roughly another 20 pages.

This year’s tax filing was over 100 pages and weighed almost 1 Kilo (2 lbs) and took hours of time to make sure I did it correctly.

Meanwhile, Sanna doesn’t have to worry about the Swedish taxes and can solely focus on the Aussie tax season since her home country and it’s tax law has a lot more sense than mine.

The question though is why. I have asked my self a few times while I make sure I have a copy of every single payslip from the previous year since the idea of a W-2 is foreign to foreign countries. Since most countries do the calculating for you, all you need to do is make sure the government got the math correct. It’s called return-free filing but I will get to that a little later.

I have learned the expat filing process the hard way through trial and error, and a lot research online. Some people go to accountants, but I stubbornly refuse to due to the principle of not paying someone to file my taxes to prove that I don’t make enough money to pay taxes back home. I can prove that fact by myself. Maybe when I become a millionaire/billionaire (or even a hundred thousandnaire), I will consider paying a third party to either make sure I pay my fair share to the US Treasury or make sure I don’t pay a dime (once again, Panama Papers-style).

Back to the why. Why does the US Government including Congress (creator of the current laws) and the Treasury (enforcer of the laws) have such a desire to waste everybody’s time including their own? Based on the news of the IRS website crashing on tax day, maybe information technology should be a higher priority than a few million expats, many of whom mostly are not making outrageous incomes and/or trying to hide vast amounts of valuable assets.

This is not a good look.

Again, why though?

To not lose out on much needed tax income?

To ensure Americans are not hiding hoards of money off-shore at a Swiss, Cayman or Bahamian bank account?

To keep all Americans on the grid?

Or all of the above?

I really haven’t found a complete answer. I am curious of the past and current reasons for the US being the only “developed” nation to double tax its citizens. America is considered a “developed” or “advanced” nation but examples like our antiquated tax policy reminds us that we are not as developed as we would think.

I do have a solution of my own. How about expats be valued like American corporations and eliminate double taxation? If that is not a motivation, then how about join the rest of the world in regards to common sense income tax law.

If you are concerned about lost tax revenue and you rely on 10 million American expats to fill the gap, then I suggest you actually take a closer look at the current tax code and maybe raise taxes instead of the current slashing of corporate and high income tax. Just an idea.

In regards to the disclosure of any off shore financial holdings, the sheer consumption of time and energy needed for this exercise actually incentives secrecy more than anything else. Instead, the IRS should focus on countries and/or companies (including banks specifically like HSBC) they believe, and have been proven, to have assisted Americans both in the US and abroad who actually practiced different forms of tax evasion and/or fraud.

Now back to the whole process of filing taxes in general. I will safely assume an easy majority of Americans both home and away can agree that the government can and should do the taxes for us.

I only foresee a strange fringe section of people who think letting the government do their taxes is surrendering control to the big bad government. Or they make money off of the third party filing companies like TurboTax. Or they really really like filling out forms.

However, I think most people would rather go with the idea of return-free filing. I think Adam does a great job at blowing a hole in the current status quo and lay out the reasons for considering such a filling system.

Yes, it can be that easy. I live in Sydney and the experience of doing taxes here and doing taxes for home are night and day. It might sound like a hyperbole, but filing taxes for the US while abroad can be months in the making. Especially if you forget to constantly make copies of important documents and you realize later that you need them and thus forced to frantically backtrack and locate your vital missing paperwork.

Meanwhile, filing my taxes (or lodging your taxes as it’s referred to here in Australia) took me no more than 30 minutes which most of that time was me learning the Australian Tax Office website and process of lodging my taxes via the MyGov website. Also, the whole thing was done online with the option to print stuff off for your own records.

I have written different people of congress about the elimination of double taxing and/or the need to consider improving the process of filing taxes in general but my words of persuasion has gone unheard.

Even if you disagree with me on how we can make the procedure of filing taxes better, I surely believe you agree with the fact that we need to modernize our tax system.